Hello Everybody

Bottom Line Up Front: My TSP remains 50% C-Fund, 50% I-Fund.

It is apparent that the stock market “summer doldrums” are indeed upon us. As most know, the month of June was mostly a sideways month, while many sectors witnessed gains, other suffered losses. While the official TSP Funds monthly returns are not published yet, S-Fund will likely be the top performer. All stocks funds are the place to be in, however determining which one will be next month’s top performer has lately been a game of throwing darts blindfolded. As discussed or alluded to in my prior post(s), the current political climate in the world’s most powerful nation is impacting the markets, there is no question that 2017 is nothing like we have seen in past years, on a variety of fronts.

A few events in June have affected the markets. On June 9, Apple Computer (a very large NASDAQ component) was downgraded, as analysts questioned its high stock price and wondered if consumers would dump the still-new IPhone 7 for the IPhone 8. This impacted other tech stocks, and resulted in the NASDAQ taking a pretty good hit on June 9 and June 12.

On June 14, the Federal Open Market Committee (FOMC) decided to raise interest rates by 0.25%. This was seen as a vote of confidence in the economy, and on June 19 the SP 500 Index attained an All Time High of 2453.82. Unfortunately, Crude Oil has been crashing to the low-40’s- some may recall prior posts that Crude Oil needs to be $55-$60 to keep oil stocks up and keep workers off the unemployment lines. Crude Oil, and related big energy company stocks (all large caps, aka C-Fund), subsequently did not do well in June.

On June 22, President Trump’s attempt at Obamacare repeal failed, with GOP senators unable to agree amongst themselves on the best path forward. The recent inability in Washington to “close deals” has not gone unnoticed by Wall Street- on June 27 and June 29, the markets sold off on high volume, not a positive sign.

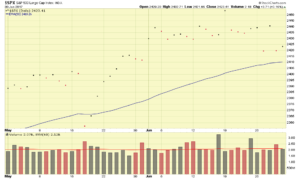

Lets take a look at some charts:

The first chart above is a “close only price” chart of the SP 500 Index, it takes away the daily volatility (daily price swings) and only depicts the price when the market closed. As you can see, the uptrend in the SP 500 is still intact. The second chart shows the High-Low-Close (HLC) price action, and the third chart depicts the same thing but with attention to the new 2420.00 support level on the SP 500, and the recent trend of the index shown.

The action in June should not create panic or instill fear in your heart: historically the NASDAQ has pulled back 10-12% each summer, typically this occurs between June 25 to August 25. To be clear, each summer the lowest point of the markets typically are 10% to 12% from their previous highest highs. If we take this historical behavior, using the NASDAQ’s recent high of 6341.70, the NASDAQ “summer bottom” should not go below 5580.70. As such, I offer the following guidelines as we navigate the summer heat and summer doldrums:

-NASDAQ summer low not to exceed 5580.70

– SP 500 long-term support level remains 2400.00

If the markets go below these levels, it warrants “heightened monitoring” however don’t be in a rush to go to G-Fund in the summer. The summer is typically lethargic and a great time to accumulate shares. It is also hard to crystal-ball which funds will do best in the future, my personal allocation remains 50% C/50% I-Fund, due to my personal opinion that if, and when, the President and Congress can get onto the same page, this will be a great positive for the economies of our country and of other nations. Our economy is doing great by all accounts, however if regulation is reduced in some industries and trade barriers removed, this will be a positive thing.

“What about my federal retirement benefits being taken away” – I hear this all the time, as stated before, I am pretty good at analysis of the stock markets, but my expertise dwindles beyond that. For that please reach out to my colleague Dan Jamison of The FERS Guide

His email is: fersguide@gmail.com

My opinion on this matter is that nothing is getting done in DC right now, and I don’t see our retirements being changed any time soon. I could be wrong, but there are simply too many pending “projects” in Washington, all of them with minimal progress, so I am not sure if, or when, the proposed changes to our retirements will get closer to reality. Note: If I was retirement eligible now, and my personal financial situation could sustain it, I probably wouldn’t wait until the last-minute to “see what happens.” I might be submitting my retirement paperwork now. COLA removal, SRS Supplement elimination, High-5 instead of High-3, I have seen various worksheets floating around reporting $25-$45,000 in annual retirement income reductions if these changes indeed take effect. The guy who has all the answers on these changes is Dan Jamison.

That concludes this update….thank you for reading and talk to you in a few weeks….

-Bill Pritchard