Hello Everybody

As I predicted previously on this site, no rate hike happened at the Sept 20-21 FOMC Meeting. Inflation targets of 2%, have not been achieved (this too, has been discussed on this site, numerous times…), and thus this appears to have been the primary factor for the lack of a rate hike. At the 35:40 time mark in the video, 2% inflation is pretty strongly mentioned, if you are a Yellen watcher like I am. Full video is below:

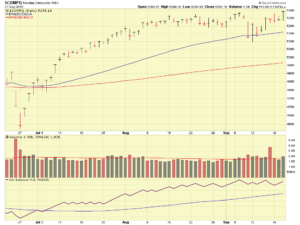

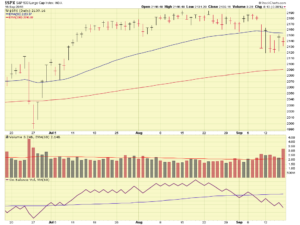

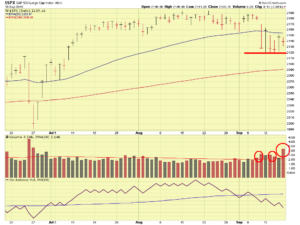

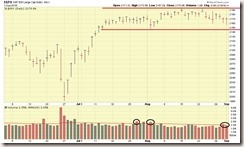

The indexes responded very positively to this, with the often watch Dow Jones Index closing up 163 points for the day. The tech-heavy NASDAQ attained a new All-Time-High (ATH) of 5299.40. See chart:

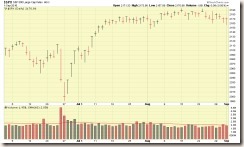

International Stocks (I-Fund) responded best to today’s news, next was Small Cap stocks (S-Fund), then large cap stocks (C-Fund). I personally am not participating in the I-Fund, but it indeed offers greater rewards (and risk) than the other funds right now.

Lets take a look at the FOMC Statement, issued after the meeting. This is not the same as Ms. Yellen’s transcript, it is more of a summary of the FOMC overall sentiment:

Information received since the Federal Open Market Committee met in July indicates that the labor market has continued to strengthen and growth of economic activity has picked up from the modest pace seen in the first half of this year. Although the unemployment rate is little changed in recent months, job gains have been solid, on average. Household spending has been growing strongly but business fixed investment has remained soft. Inflation has continued to run below the Committee’s 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will strengthen somewhat further. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Jerome H. Powell; and Daniel K. Tarullo. Voting against the action were: Esther L. George, Loretta J. Mester, and Eric Rosengren, each of whom preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

It is evident that the FOMC is pretty set on achieving 2% Inflation, and without this achievement, I do not see rates being raised. The next meeting with a possible rate hike is December 13-14.

On Friday Sept-23 12PM Eastern Time, Federal Reserve Bank of Philadelphia President Patrick Harker, Cleveland Fed President Loretta Mester and Atlanta Fed President Dennis Lockhart participate in “Presidents’ Perspectives: The Fed’s Role in Our Communities“ in Philadelphia. It is possible that interest rate discussions (but no action can be taken, this is merely a forum) will occur at this meeting.

Interesting is that the same talking heads on the cable business shows, to include major fund managers, all who erroneously “predicted” a rate hike to occur this September meeting, are now backpedaling and now claim that triple cross your heart, that a rate hike will occur in December “for sure.” I suppose even a broken clock is correct twice a day.

Thanks for reading and talk to you soon. Thanks for being a supporter. I think I have analyzed these FOMC meetings for 2 years now and each time I “called it” with 100% accuracy. Just saying…

I remain 50% S-Fund and 50% C-Fund.

-Bill Pritchard