Hello Folks

Hope everyone is doing well…you have every reason to be pleased if your TSP Allocation currently reflects any combination of C/S/I-Funds, as all have done very well during the last two weeks. As a matter of fact, the Dow Jones Index (only 30 large cap stocks, FYI…) just posted its largest weekly gain in over a month.

My decision on March 29 to change my TSP fund allocations and contributions to 50% S-Fund and 50% C-Fund appears (so far…) to have been the correct decision. The market declined very slightly immediately after March 29, which invited some “fan mail” regarding my decision to return to the markets.

However this slight decline simply meant that my fund change resulted in a re-entry to the markets at a “cheaper price”. Observe that my decision on March 29 was based on months of analysis and monitoring the market’s behavior, since August 2015.

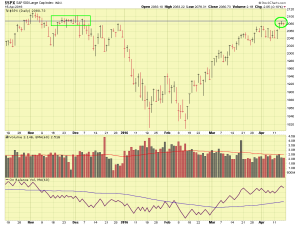

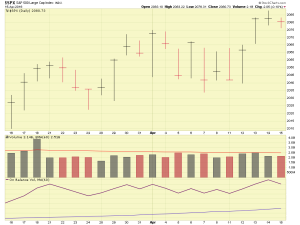

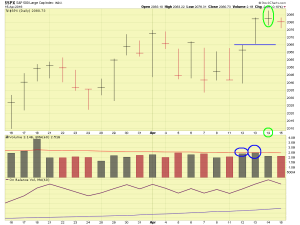

On April 13, the SP-500 Index “gapped up” (explained here before, also explained at this link here ), on higher volume than the previous day. A gap-up, on high volume, is extremely positive and is akin to a huge splash in a small pond when an elephant jumps in. Lets take a look at that action:

The index then traded higher the next day on April 14, and hit 2087.84, which is the highest level since December 7, 2015; this is definitely a positive sign. See longer range chart below:

To back up my chart analysis, I have consulted other resources and I am pleased to see that the good folks over at Investors Business Daily report that the Accumulation/Distribution grade in the markets are “B” (A is best), which is an improvement over the prior 30-60 days, reflecting that institutions are coming back into the markets. Volume action is still lower overall, however the price action is trending upward, so for now, I am pleased with the market’s behavior.

A factor behind this uptrend, is rising Crude Oil prices, currently priced in the $40 range, much higher than prior levels, and getting closer to the $50-55 level which most feel is the “sweet spot” for oil companies to be profitable again, yet not so high as to trigger high-priced gasoline for the retail customer (mom and dad) at the pump. Even $45 would be a good level to seek and stabilize at. Lets take a look at a chart of Crude Oil:

As can be seen, since February, the price has recovered, albeit not without a slight downtrend in late March.

In my opinion, there are no major challenges for the markets at the present time. We are indeed in earnings season, but I don’t get too wrapped around the axle about “earnings season” because the way I see it, all year is earnings season. The next FOMC meeting with a public announcement by Chair Janet Yellen will be June 15, a rate hike may or may not be announced or discussed.

In sum, the markets have done very well since my decision to return to stock funds- my TSP reflects 50% S-Fund and 50% C-Fund.

Thank You and have a great weekend everybody

-Bill Pritchard