Hello Folks

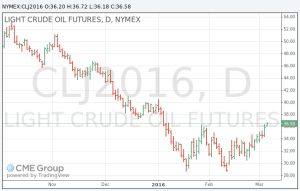

I am happy to report that I am exiting the G-Fund and returning to the stock funds, more specifically 50% S-Fund and 50% C-Fund, via interfund transfer and a contribution allocation reflecting this percentage (FAQ #10). Small Cap stocks (S-Fund) have performed very well in recent weeks, however it is probable that Large Caps (C-Fund) will also be responding well, thus I am getting some exposure to both funds.

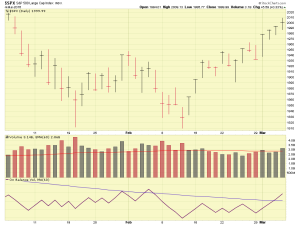

Recent market action reflects a growing uptrend, on lackluster volume, however the market volume picked up the afternoon of 03-29-16, after FOMC Chairwoman Yellen spoke regarding her assessments of the economy. In addition, the SP-500 futures trading during the evening hours of 03-29-16, broke to a new recent All-Time-High, reflecting positive sentiment in the evening hours. See chart:

This return to stock funds is a welcome event, nobody enjoys sitting on the beach while everyone else is out in the ocean playing in the waves and enjoying their surfboards. However I believe the continued position in G-Fund will cause me to miss future gains, and that the market environment is indeed much less risky than 60-90 days ago. At some point, we can’t “risk assess” ourselves out of existence, at some point we have to get out of bed, and go out into the world and face whatever obstacles come across our path. There are only so many factors one can control, or influence. Based on my review of the chart action, the improving volume action, and the Accumulation/Distribution activity in the indexes, I feel that the threat level is much reduced, and a return to stock funds is justified. Just FYI that things may go south, depending on how the elections go. Let’s stay alert and aware.

Again, I will be 50% S-Fund and 50% C-Fund. Any TSP changes submitted by COB on Wednesday should take effect by Friday evening. If the market dips slightly over the next few days, that is fine, you are entering while it is slightly down. Remember, we are looking at long-term behavior (note that I have been in G-Fund since August) in the markets, not one-day or even one-week cycles. This serves as partial explanation as to why I only post every week to two weeks.

Thank you for reading, hope everyone is doing well. Have a great week

-Bill Pritchard