Hello everyone

First, I remain 100% S-fund. Many will stop reading at this point. For those who wish to continue, March 10 was not a pretty day in the markets, the media’s favorite index, the Dow Jones Index (only representing 30 stocks, far from a “good yardstick” of the entire market) was down over 300 points. Volumes were up on all indexes, indicating distribution or “sell off” activity. Today’s post will not have any of my typical charts, it will however attempt to address the “rate hike” issue, mostly the what, why and the when. Many have approached me for some insight into this, as it is mentioned often enough in the financial press but no real background is discussed regarding this subject. Numerous other TSP sites have talked about everything but this topic, so I am eager to fill in the voids which exist. The following represents my opinion and my assessment based on how I see things.

It is my opinion that the March 6 and March 10 sell-offs are directly attributable to fear of the rate hike.

The what: The Federal Open Market Committee (FOMC) is expected to raise short-term interest rates, many believe this will occur (the when) in summer/fall 2015. As anyone with a desk calendar knows, we are approaching mid-March and Spring.

The why (this is important for us): Rate hikes in theory are believed to result in increased borrowing costs for consumers, large business (who may be buying airplanes, heavy equipment, etc.), home buyers, and others. Increased borrowing costs may result in reduced spending, which is counter productive to the economy.

In summary: Increased interest rates are feared to choke off or hamper business and consumer spending.

With that very brief, Cliff Notes version, lets take a look at the January 28 FOMC policy statement, available at this link below and cut and pasted into this post.

http://www.federalreserve.gov/newsevents/press/monetary/20150128a.htm

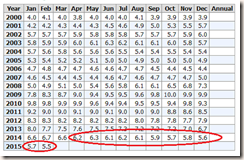

Evident via the red highlights, is that fact that the term “maximum employment” is used three times, and that “inflation of 2 percent” is used twice. It is apparent that both of these two items are important to the FOMC, prior to raising rates. Remember, both. Inflation rate is based on the Price Consumption Expenditure (PCE) measure. Most feel that “maximum employment” means that the unemployment statistics must be below 6.5%, which they have been for almost twelve months now. See table:

So we have one of the “both” criteria, pretty clearly established, for almost a year’s timeframe. However, the FOMC also seeks 2% inflation rate, and we are not there yet. Note they don’t want inflation higher than, or lower than 2%, they want 2%. See graphic:

It is believed that the super cheap oil prices have thrown the inflation rate figures off, hence they are super low. “Why 2%” and not 3 or 4%? That is really not known, most conclude “because that is what the FOMC wants” and no additional clues or explanation has really been offered by the FOMC as to that particular number.

The point is this: An influential government body has released to the public a policy statement. Multiple times in that statement, they mentioned that they want both a good employment picture and 2% inflation. Well, we haven’t achieved both. Regarding inflation, we are not even close. So I am not so sure that we do see rate hikes in Summer/Fall. I myself previously believed this also, until digging into the FOMC statement.

The FOMC meets again March 17-18, so until then, I expect some market nervousness and increased volatility. As always, I will ultimately respond to the market itself, but based on some additional analysis, to include the above, the Dow Jones 300 point drop on March 10, in and of itself, while not desired, is not causing me to change anything. If the FOMC murmurs, whispers, implies, anything regarding delaying the rate hike (likely due to inflation targets not met), the markets are going to the stratosphere. MY OPINION and standard disclaimers apply.

It is what it is: we have major elections in the not too distant future (Nov-2016) and this is not the environment for the government body, which oversees national monetary policy, to waffle on their statements or take actions when previously mentioned requirements are not met. The current administration and political party has enough fires to put out, they don’t need more. FOMC Chairperson Yellen is a Presidential appointee. Vice-Chairperson William C. Dudley, also a Presidential appointee, is in charge of the Federal Reserve Bank of New York (aka Wall Street). A violation of the “both” criteria (a rate hike with only one or the other criteria), with a subsequent interest rate hike, could severely damage many 401k balances, retirement plan balances, and the net worth of many voters. This is more critical the closer we get to November 2016. I don’t anticipate any deviation from the “both” criteria.

I remain 100% S-Fund. Thank you for reading and continuing to share this site with your friends and colleagues.

– Bill Pritchard