Hello Folks

Well this month has been somewhat quiet as far as updates are concerned, however “no news is good news” and there is nothing really negative to report this month. My choice to re-enter S-Fund on November 2 has been very rewarding, as the markets continue to climb upward, with the SP 500 Index making a new 52 week high of 2074.21 on November 25.

The top performing fund remains S-Fund, based on my analysis, with C-Fund close behind. My personal TSP Allocation remains 100% S-Fund however 50%/50% C-Fund and S-Fund would be fine also.

Lets take a look at some charts, without comments, then with comments:

As can be seen on the charts, the SP 500 and NASDAQ indexes “found a bottom” in mid-October then began an uptrend. Initial volume after mid-October was very strong, then volume dried up somewhat. With that said, the number of above-average volume “up days” is twice the amount of “down days”, Six up days versus three down days on the NASDAQ. This placates my concerns over low volume, however I do wish for higher volumes as volume is what sustains trends. To keep a rocket going, it needs thrust and horsepower to drive it upward, and that is the role of volume in the markets. The same rocket can run out of fuel and fall to earth all by itself. The same thing occurs in the markets. Volume is not needed to drive a market downward, but it is needed to keep it going up. In my typical fashion I over articulated what I could have said in simple terms, so in summary, I would like to see more volume.

While we are on the topic of volume, this week (Nov 24-Nov 28) will be a reduced volume week, as many market participants are sitting out due to the Thanksgiving holiday on November 27, a date in which the markets are closed. So don’t expect to see huge volumes in the indexes nor in individual stocks.

It should be noted that historically November, December, and January are the best performing months out of the calendar year, with December being the best month of all. So if history repeats itself (as it usually does…), those in the stock funds should do well over the next few months. Observe that the behavior of the markets in January almost always “sets the tone”for the rest of the year, so we should keep an eye on January. I think this year will close out really well, we have had plenty of good economic news, oil prices are at 4 year lows, and the mood in American is generally positive.

This site is about the TSP plan, and not stock picking (plenty of sites out there for that), however due to constant arm twisting I am going to touch very generally on some stocks I either have now or am “looking at”. Recall that I primarily am a technical investor (charts) BUT need a “story” to back up the chart. These are NOT investment recommendations. These could all roll over and go to zero (0) tomorrow.

AAPL: I think this company has a great future and the top selling “cell phone cases” on Amazon is IPhone 6, IPhone 6, and IPhone 6. Take a guess how well the IPhone 6 is selling…

GPRO: While the stock is volatile, GoPro cameras are a very “hot” item and I think the future is bright.

AAL: The largest airline in the world, post-merger with US Airways, will likely dominate all others, especially as business travel (the economy) continues to rebound. If it can get thru some hiccups associated to the merger and different labor groups, I see AAL with blue skies ahead.

In the “other news” category, and since the majority of my audience is “6(c)” community (if you have to ask, you aren’t in that community), I wanted to share some news out of Austin, Texas. You may recall prior discussion on this site regarding the San Angelo City Park project, regarding Austin Police Officer Jaime Padron, who was killed on duty in 2012. Jaime was a fellow college alumni of mine, also a close friend, and I along with others, worked to get the aforementioned park, now called Jaime Padron Memorial Park, built and finished. Jaime was a USMC veteran and graduate of Angelo State University.

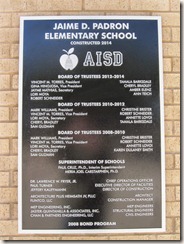

Flash forward to November 9, 2014, which was the dedication ceremony for Jaime Padron Elementary School, in Austin, Texas. This new school is Austin ISD’s largest elementary school and is staffed by some really great teachers and folks. I was honored to be invited to speak at this dedication, to a very large crowd, consisting of students, teachers, community leaders, area law enforcement, Austin ISD Superintendent Dr. Paul Cruz and Austin Police Chief Art Acevedo.

It is important that our fallen officers never be forgotten, and equally important that we appreciate and recognize the challenges and dangers law enforcement face every day. My speech at the dedication was entirely dedicated to that very topic. Here are some pics from the event:

Standing next to Jaime’s brother Johnny (black jacket) along with law enforcement friends and Austin Chief Art Acevedo

Chief Acevedo speaking to audience. I have not met anyone who can speak with such ease and ability as Chief Acevedo.

Speaking regarding the meaning of the word “hero”

Participants in construction, completed in 2014

We must not forget why we do what we do

That’s it for this update. To repeat, I remain 100% S-Fund and I see no red flags ahead.

Happy Thanksgiving to everyone and talk to you soon

– Bill Pritchard