Hello Everybody

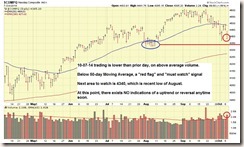

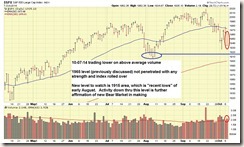

On 10-07 the Dow Jones got slammed with a 272 point loss by end of day. This is not the signal of a pending new upturn. Lets take a look at some charts:

As stated, the Dow Jones Index went down 272 points. This is a very significant amount and associated to institutional investors “fleeing” the markets. The various financial news websites are discussing Europe fears, etc. stuff, but as you know, on this free site, since August 7, I have discussed my own concerns of market weakness. Eight short weeks later, October 7, and the wheels are starting to come off the market’s axle, as the bus apparently rolls downhill with no brakes and no concern for the destruction it leaves behind. Unless, of course, you are in G-Fund, which is where I am now. It should be noted that all TSP Stock funds had negative returns in September, a month that I was in G-Fund for the entire time, as were many Fed Trader followers.

It should be additionally noted that last week, Thursday 10-02, and Friday 10-03, the markets went up, on decent volume, and some “experts” in the financial press could be found celebrating how the prior down days (before 10-02) were “temporary blips” and the “market is going into the weekend on an upbeat note.” Some sites celebrated the “positive jobs report”, ignorant of the fact that the positive jobs report only added another layer of cement onto the sealed deal called guaranteed interest rate hikes in 2015.

The 1965 level which I discussed on this site on Sept 30, was barely touched and no significant penetration on 10-02 nor 10-03, so I immediately knew those days’ action were just a feeble attempt by the market to make some final gasps.

It is valuable to note that in prior Bear Markets, the major flash fire really only got going until 8 weeks after the recent market peak of the prior Bull. Some smoke and a few sparks here and there, but the major crash did not start for 8 weeks or so (approx). Our peaks in the NASDAQ and SP500 have been basically “mid September” so using this general guideline, it is possible that “mid November” we see a major downward slide. Possible. This may be a little earlier or a little later. But if my beliefs are correct that a new Bear is in the works, then my opinion is “mid November” is something to monitor.

None of the above, or information from my prior posts, has been put forth by similar TSP websites, easily found via Google, of which many exist. Nobody is talking about increased volume and distribution, or support levels on the SP 500. That level commentary is available at the The Fed Trader, but nowhere else. If you want cut and pasted news articles and regurgitated “buy and hold” mantra, it is readily available, trust me. If you want tactical decision making and the reasons behind it, only one place has it, The Fed Trader. A cursory glance at “the other sites” show many absurd recommendations, such as S-Fund, partial L-Fund and C-Fund, and other stuff. Folks, the Dow Jones (over the last few weeks) has taken 200 point, 250 point, 272 point blows. That is not a “we think the market will do this” or “it is likely that” kind of stuff. Those triple digit losses have happened. They occurred. Period, the end. Also, we have a fundamental/economic back-drop of pending interest rate hikes, European economic concerns, military action against ISIS (which will cost money and impact the federal budget), mid-term elections, and other things in-play. Let the numbers talk. Fed Trader readers in the G-Fund in September, lost no money to their account balances. Other website readers, lost money. S-Fund was down 5% in September. That means a $500,000 TSP non-Fed Trader subscriber saw $25,000 evaporate in September.

I remain 100% G-Fund. Please continue to share this free site with your friends and colleagues. I sign my name after every post and my picture is posted in the event someone wants to throw darts at it. I encourage folks to find a similar site which does the same and has the same transparency.

I hope everyone has a great week.

– Bill Pritchard