Hello Everyone

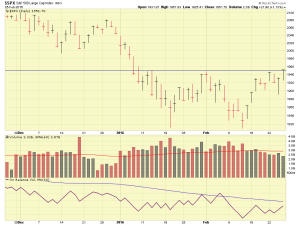

On Feb-25, the SP-500 broke the previously discussed 1950 level, hitting 1951.83, before closing at 1951.70, however volume was lackluster… below the average trading volume and less than the prior day’s volume. As many readers know, volume is the horsepower behind the move. Please see charts:

While I celebrate the fact that we broke thru 1950, I am less than celebratory regarding the volume. As such, I remain cautious and will not be making any moves out of G-Fund until I see volume pick up. As discussed in my prior post, we need to break above 1950 (we did that), and we need volume (we don’t have that), to sustain any new trend change.

All of this, (surprise) is tied to crude oil movement. I heard someone the other day mention that whether we know it or not, we are all “oil traders” now. I agree with that assessment, as every time that crude oil makes a move, the stock investor is affected. Another factor (yet another shocker) is that reports of a slowing Global economy, and slowdown in China, are impacting our markets.

Let’s continue to monitor things, volume in particular. To demonstrate what “strong volume” looks like, take a look at the below March 2003 chart of the SP-500, in which the NASDAQ-bear market (2000-2003) finally reversed itself. Compare this chart to the above charts:

Clearly the above 2003 volume is not what we are seeing right now. The catalyst and trigger event for this volume was the March 2003 invasion of Iraq by US military forces. Yes, a pretty big catalyst. The above 2003 chart, when I saw that, I couldn’t get out of G-Fund fast enough. Back then, this site did not exist, and my TSP analysis was via a Yahoo email list, sent to about 20 of my co-workers.

Back to the future, or at least to the present. Right now, I am 100% G-Fund and still sitting tight. Everybody have a great weekend and talk to you in a week or two, as we continue to watch things. Thank you for reading !

-Bill Pritchard